A First Look at Nielsen’s Total Audience Measurement and How It Will Change the Industry

Rollout begins in December

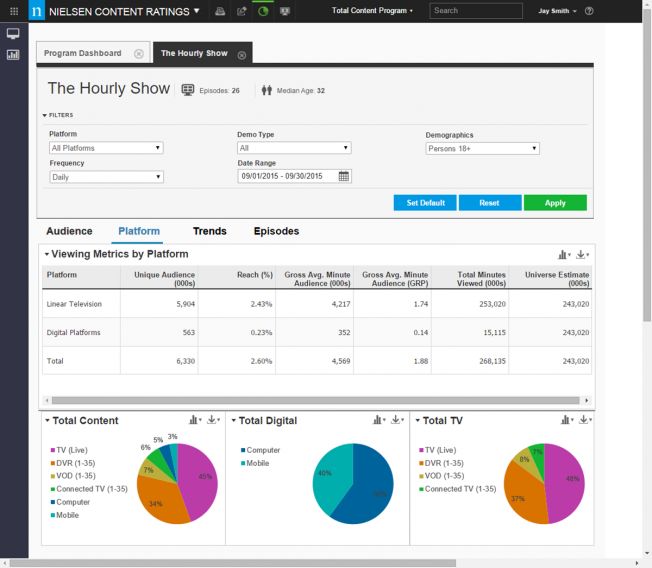

Nielsen’s total audience measurement will finally give the industry the data it has been clamoring for. Image: Nielsen

It’s been two years since Nielsen first began developing a tool to measure viewers across all platforms—not just TV watchers as it has for the last 65 years. Since then, however, the project has attained mythical status among many advertisers, buyers and network executives. “I’ll believe it when I see it,” more than one has told me dismissively in recent months.

But the wait is almost over. Nielsen is putting the finishing touches on total audience measurement and gave Adweek an exclusive look at its new multiplatform measurement tool, which it says will forever change the industry. The company will begin sharing data with its clients this December and roll out the tool’s full capabilities early next year.

To paraphrase Seinfeld, total audience measurement is real and, given the industry’s growing cries this fall (in the face of more live TV viewership declines) for a tool that will finally allow them to fully measure and monetize viewers, it’s spectacular.

Nielsen has spent two years working on the framework, as it worked to align the disparate metrics for video content. The company has long had the capability to measure ratings up to 35 days after live airing, for both linear and digital TV. But evp Megan Clarken, who is leading the project, said this is over and above anything Nielsen has ever compiled. “What we have to do to perform a cross-platform total audience measurement is line all of those numbers up, so they have to be apples-to-apples comparisons,” Clarken said. “They have to follow the same underlying rules. They have to be on a single-sourced platform, because otherwise you’re cobbling numbers together and creating Frankenmetrics.”

The result is total audience measurement, Nielsen’s single-sourced platform to account for all viewing across linear TV, DVR, VOD, connected TV devices (Roku, Apple TV and Xbox), mobile, PC and tablets. The only thing left out: streaming content on wearables like the Apple Watch. “There’s always going to be things that are so small for us right now,” said Clarken.

“What we’re acutely aware of is our measurement underpins $70 billion worth of advertising,” she added.

While TV ratings would indicate that television viewership is in continued decline, especially this fall, “video viewing is actually relatively flat, but it’s moved,” said Clarken, as audiences continue to shift from live TV to watching VOD and connected devices or streaming them via mobile or tablet devices, which are not measured in the industry’s standard C3 and C7 ratings metrics. Digital first providers like YouTube and AOL have also been shut out. They will now be included.

An early test of Nielsen’s total audience measurement reveals just how much of a program’s audience is overlooked by the current C3 and C7 metrics. For one client’s broadcast drama that aired in early September, Nielsen found the following:

- 45 percent of the episode’s audience watched during its live airing

- An additional 32 percent watched it via DVR during the first seven days after it aired

- 2 percent watched on DVR between 8 days and 35 days after it aired

- 7 percent of the audience watched it on VOD from within 35 days

- 6 percent watched via a connected TV device

- 8 percent watched digitally, streaming it on a PC, mobile device or tablet

Notably, among the adults 25-34 demographic, only 15 percent watched the episode live (compared with 64 percent of adults 50 and older). Of that same 25-34 demo, 22 percent used a connected TV to watch the show, and 18 percent watched it digitally, the highest of any demo.

“No longer are [networks] just stuck with [live viewers],” said Clarken. “Through total audience, we’re now picking up all of their viewing across DVR, VOD and connected TV, and able to add that together so they can get a real sense of their audiences, and not just be restricted to reporting out or talking about their live audiences. Live and DVR is very dominant in the older demographics, very less predominant in the younger demographics, so being able to measure that is extremely valuable.”

Meanwhile, other shows will discover that they are not as popular across all platforms. Another Nielsen client asked the company to measure its audience across digital devices only to learn that its lift is minuscule. “What this does for them is it tells them that and it allows them to reset their strategies” to reduce dynamic ad load, said Clarken.

The first look at Nielsen’s total audience measurement tool, coming early next year.

The total audience measurement tool, which will roll out late in the first quarter of 2016 (Nielsen will begin to share data with clients in December, allowing them full access to the tool), will allow users to break down programs by categories like unique audience, reach, gross average minute audience (both in viewers and GRP—gross ratings point, where one GRP is equal to 1 percent of TV households), minutes viewed and frequency (the average number of exposures to a show or network). Users can search across a variety of demos, date ranges and platforms. …

… read on at adweek.com

Originally posted by

Megan Clarken will be speaking at the 2015 asi European Television Conference on 4th-6th November in Venice, Italy